Employees' state insurance, commonly known as ESI, is a social security scheme that provides socio-economic support to employees during unforeseen situations. Through this self-financing fund, insured employees and their dependents can claim medical care benefits, coverage for sickness, maternity leave, temporary or permanent physical disablement expenses, funeral expenses, and confinement expenses. If an injured person dies due to an employment injury or disease, their dependents are eligible for monetary support under ESI, too.

ESI is managed by the Employees' State Insurance Corporation (ESIC) and mandated by the Ministry of Labour and Employment of the Government of India. Both an employer and employee contribute a shared 4% of the employee's gross pay towards the ESI fund each month.

Any business establishment in India employing 10 or more people should voluntarily register with the ESIC within 15 days from the date of applicability.

To make the registration process easy for business owners, the statutory body has made the registration process fully online. No physical copies of documents are required. However, there are a few soft copies of documents that you should have on hand to ensure a quick registration.

Here's a tutorial with screenshots on how to register your business for ESI.

The last date to pay your ESI contribution is the 15th of every month. Employers registered under the scheme should deposit the due amount in a bank authorized by the statutory body before the deadline.

Here's a step-by-step guide with screenshots for making online payments and generating ESI challans online.

Employers should submit half-yearly returns using the Return of Contributions form (RC). For the contribution period of April to September, the due date to file returns is 12th of November and for the October to March period, the last date is 12th of May.

Note: If you have 40 or more employees, you have to upload a CA certificate before submitting the return. A CA certificate is issued by chartered accountants acknowledging that they have verified the returns based on the records and registers of the company.

Employers who have followed the above steps are considered to have properly filed their ESIC returns for that particular contribution period.

The amount deducted by the employer under the ESI Act is considered entrusted to them by the employee for the purpose of contributing towards the ESI fund. Any delay in payment or non-payment of contribution amounts is considered "Breach of Trust" which is a crime punishable under IPC 406 and 409. It is also an offense under section 85 of the ESI Act.

An employer who fails to pay their contribution has to pay a simple interest at the rate of 12% per annum for each day late.

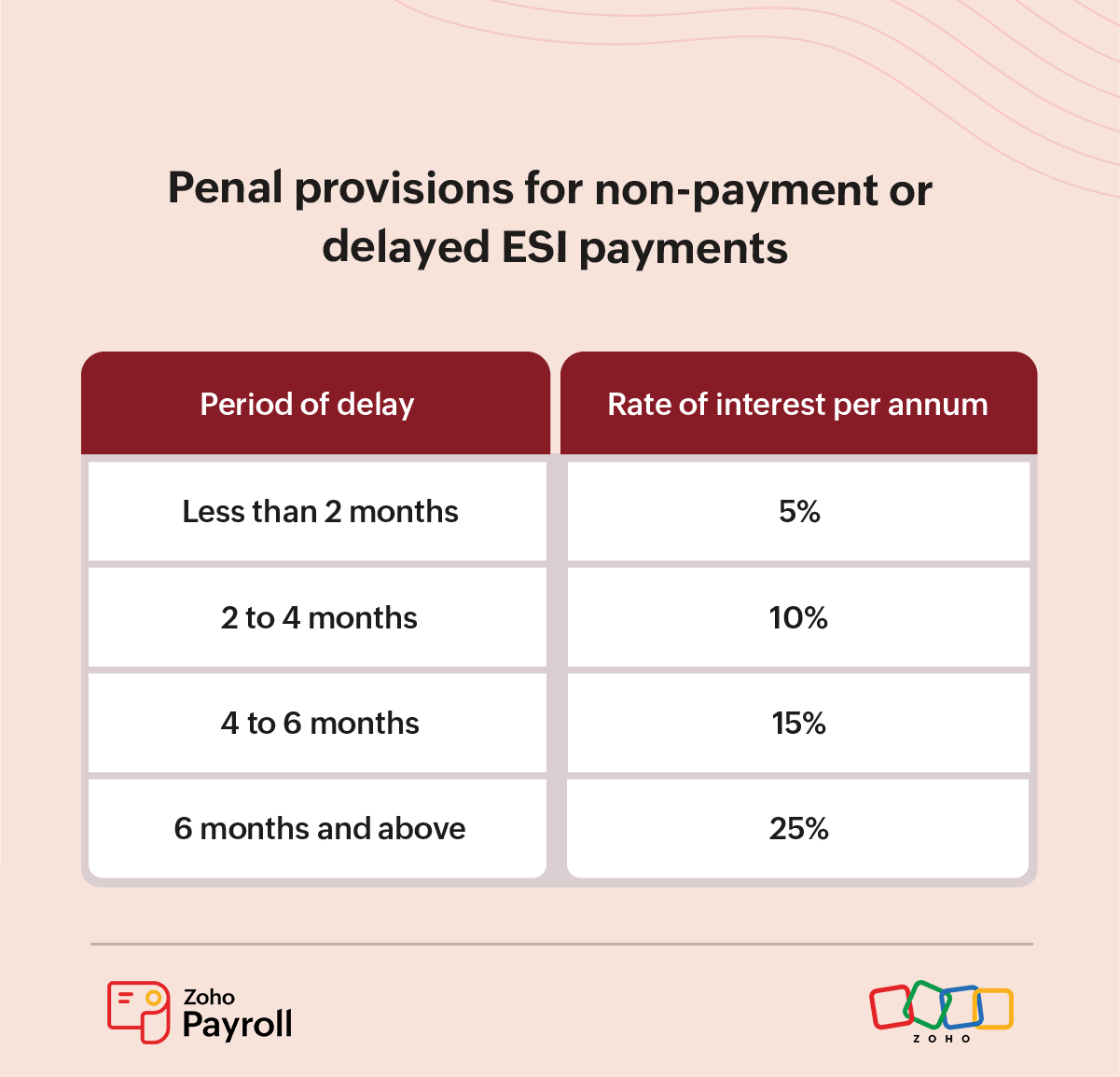

The ESI department can also levy penal provisions on the employer for delays in payment or non-payment.

| Form | Description |

| Form 01(A) | Form of Annual Information |

| Form 1 | Declaration Form |

| Form 2 | Addition/Deletion in Family Declaration |

| Form 3 | Return of Declaration Form |

| Form 6 | Register of Employees |

| Form 9 | Claim for Sickness/Temporary Disablement Benefit/Maternity Benefit |

| Form 11 | Accident Book |

| Form 12 | Accident Report |

| Form 12A | Claim for Maternity Benefit for Sickness |

| Form 13 | Claim for Sickness or Temporary Disablement or Maternity Benefit |

| Form 14 | Claim for Permanent Disablement Benefit |

| Form 15 | Claim for Dependent Benefit |

| Form 16 | Claim for Periodical Payment of Dependent Benefits |

| Form 19 | Claim for Maternity Benefit and Notice of Work |

| Form 20 | Claim for Maternity Benefit by a Nominee |

| Form 21 | Maternity Benefit - Certificate of Expected Confinement |

| Form 22 | Funeral Expense Claim |

| Form 23 | Life Certificate for Permanent Disablement Benefit |

| Form 24 | Declaration and Certificate of Dependent's Benefits |

Maintaining spotless statutory compliance is a must for every business owner. If anything goes wrong, you will have to pay hefty fines and tackle a tarnished brand reputation. Zoho Payroll, cloud-based payroll software, keeps you legally compliant so you can focus on growing your business.

Using Zoho Payroll, you can automatically calculate and deduct employees' ESI contributions before processing every pay run. It allows you to maintain a clean statutory record by generating ESI summary reports and ESIC return reports in real time.

Your email address will not be published. Required fields are marked